Prepare for the Unit 3 AP Microeconomics Test with this comprehensive guide! Dive into the fascinating world of market structures, consumer behavior, and industry performance, and gain a deeper understanding of how economic forces shape our daily lives.

From analyzing the characteristics of different market structures to understanding the factors influencing consumer demand, this test covers a wide range of essential concepts that will equip you with a solid foundation in microeconomics.

Market Structures

Market structure refers to the number and size distribution of firms in a market, as well as the degree of competition among them. It influences firm behavior, industry performance, and the overall functioning of the market economy.

Unit 3 of AP Microeconomics can be a challenge, but don’t worry! There are resources available to help you ace the test. For instance, you can find a quiz quiz trade template free online that can help you practice the concepts you’ll need to know for the exam.

Unit 3 covers topics like supply and demand, elasticity, and consumer and producer surplus. By using a quiz quiz trade template free, you can test your understanding of these concepts and identify areas where you need more practice. So, don’t wait! Start preparing for Unit 3 of AP Microeconomics today!

Perfect Competition

- Many small firms, each with a negligible market share

- Identical, standardized products

- Firms are price takers

- Perfect information for all participants

- Free entry and exit

Examples: Agricultural markets, stock exchanges

Monopoly

- Single seller

- No close substitutes

- High barriers to entry

- Firm has market power

Examples: Natural monopolies (utilities), patents

Oligopoly

- Few large firms dominate the market

- Products may be differentiated or standardized

- High barriers to entry

- Firms are interdependent in their decision-making

Examples: Automobile industry, telecommunications

Monopolistic Competition

- Many small firms, each with a small market share

- Differentiated products

- Low barriers to entry

- Firms have some market power

Examples: Restaurants, retail stores

Consumer Behavior

Consumer behavior is the study of how individuals and households make decisions about spending their money. It is a complex field that draws on economics, psychology, and sociology to understand how consumers make choices.

Factors that Influence Consumer Demand

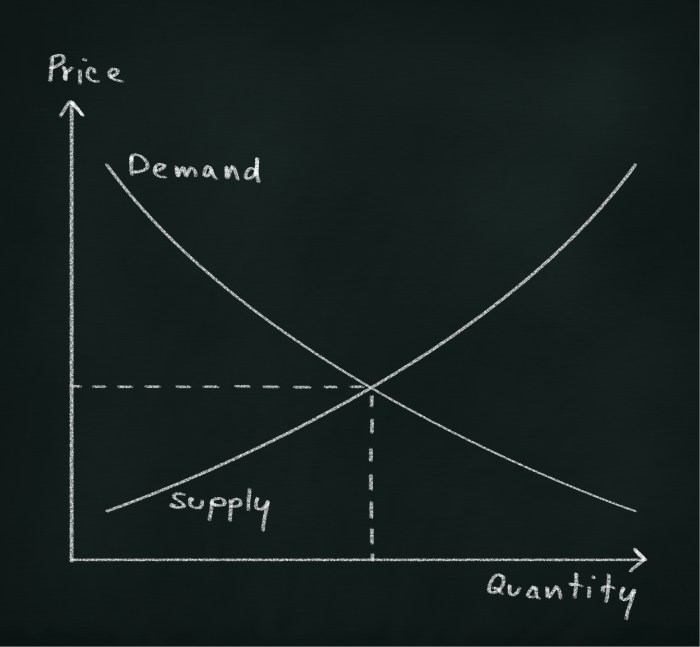

The demand for a good or service is determined by a number of factors, including:

- Income:Consumers with higher incomes are more likely to demand more goods and services.

- Prices:Consumers are more likely to demand goods and services that are relatively inexpensive.

- Tastes and preferences:Consumers’ tastes and preferences for different goods and services vary widely.

- Expectations:Consumers’ expectations about future prices and incomes can also influence their demand for goods and services.

Types of Consumer Demand Curves

The relationship between price and quantity demanded can be represented by a demand curve. There are three main types of demand curves:

| Type of Demand Curve | Slope | Example |

|---|---|---|

| Normal | Negative | Most goods and services |

| Inferior | Positive | Goods that are less desirable as income increases (e.g., ramen noodles) |

| Giffen | Positive | Goods that are more desirable as prices increase (e.g., bread during a famine) |

Consumer Surplus

Consumer surplus is the difference between the price consumers are willing to pay for a good or service and the price they actually pay. It is a measure of the benefit that consumers receive from consuming a good or service.Consumer

surplus can be measured using a demand curve. The area below the demand curve and above the price line represents consumer surplus.Consumer surplus is important because it measures the value that consumers receive from consuming a good or service. It is also a factor that producers consider when setting prices.

Production and Costs

Production refers to the process of converting inputs (such as labor, capital, and raw materials) into outputs (goods and services). Costs, on the other hand, are the expenses incurred in the production process.

Types of Production Functions

A production function is a mathematical relationship that describes the maximum output that can be produced with a given set of inputs. There are several types of production functions, including:

- Linear Production Function:Output increases at a constant rate as inputs increase.

- Cobb-Douglas Production Function:Output is a power function of the inputs, where the exponents represent the elasticity of output with respect to each input.

- Leontief Production Function:Output is fixed in proportion to the minimum input used.

- Isoquant Production Function:Shows all combinations of inputs that produce the same level of output.

Types of Production Costs

Production costs can be classified into various types, as shown in the following table:

| Type of Cost | Definition |

|---|---|

| Fixed Costs | Costs that remain constant regardless of the level of output, such as rent and insurance. |

| Variable Costs | Costs that vary directly with the level of output, such as raw materials and labor. |

| Total Costs | The sum of fixed and variable costs. |

| Marginal Cost | The change in total cost resulting from a one-unit increase in output. |

| Average Total Cost | Total cost divided by the level of output. |

| Average Fixed Cost | Fixed cost divided by the level of output. |

| Average Variable Cost | Variable cost divided by the level of output. |

Relationship between Production and Costs in the Short Run and Long Run

The relationship between production and costs differs in the short run and long run.

In the short run, at least one input is fixed, while in the long run, all inputs are variable. This distinction affects the way costs behave as output changes.

In the short run, as output increases, marginal cost initially decreases due to increasing returns to scale. However, as output continues to increase, marginal cost eventually increases due to diminishing returns to scale. In the long run, with all inputs variable, marginal cost typically increases as output increases due to diminishing returns to scale.

Perfect Competition

Perfect competition is a market structure in which numerous buyers and sellers engage in transactions involving identical products, and no single entity has the power to influence the market price. This structure is characterized by:

- Many buyers and sellers: No individual buyer or seller can significantly impact the market price.

- Identical products: All firms offer the same standardized product, eliminating product differentiation.

- Perfect information: All market participants have access to the same information, preventing any individual from gaining an advantage.

- Free entry and exit: Firms can freely enter or exit the market without barriers, ensuring that the number of firms adjusts to meet market demand.

Conditions for Perfect Competition, Unit 3 ap microeconomics test

For perfect competition to exist, several conditions must be met:

- Large number of buyers and sellers:No single entity should have a substantial market share to avoid influencing prices.

- Homogeneous products:Products should be identical and interchangeable, eliminating brand loyalty or product differentiation.

- Perfect information:All market participants must have equal access to information about prices, product quality, and market conditions.

- Free entry and exit:Firms should be able to enter or leave the market without facing significant barriers, ensuring that the number of firms adjusts to meet market demand.

Equilibrium in Perfect Competition

Short-Run Equilibrium:In the short run, a perfectly competitive firm will produce output at the quantity where marginal cost (MC) equals market price (P). At this output level, the firm maximizes its profit or minimizes its losses. Long-Run Equilibrium:In the long run, firms will enter or exit the market until the market price equals the minimum average total cost (ATC) of production.

At this point, all firms will be earning zero economic profit, and the market will be in long-run equilibrium.

Monopoly

A monopoly market is a market structure characterized by the presence of a single seller (monopolist) who has complete control over the supply of a good or service. In other words, the monopolist is the sole provider of the product in the market, and there are no close substitutes available.

The defining feature of a monopoly is the lack of competition. This allows the monopolist to set prices, restrict output, and earn above-normal profits. Monopolies can arise from various sources, including government-granted patents, control over a key resource, or economies of scale.

Sources of Monopoly Power

The sources of monopoly power can be categorized into the following:

- Government-granted patents:Patents grant exclusive rights to inventors, giving them a temporary monopoly over the production and sale of their inventions.

- Control over a key resource:Ownership or control over a scarce resource, such as a natural resource or a unique technology, can create a monopoly.

- Economies of scale:In some industries, large-scale production is more efficient than small-scale production. This can lead to a natural monopoly, where a single large firm can produce the entire market output at a lower cost than multiple smaller firms.

Profit-Maximizing Behavior of a Monopolist

The profit-maximizing behavior of a monopolist differs from that of a firm in a competitive market. In a competitive market, firms are price takers, meaning they must accept the market price set by the interaction of supply and demand. However, a monopolist has market power and can influence the market price.

To maximize profits, a monopolist will set a price above marginal cost. This is because the monopolist has the ability to restrict output and create a shortage in the market, which drives up the price. The monopolist will also produce less output compared to a competitive firm, as a higher price leads to a lower quantity demanded.

Monopolistic Competition

Monopolistic competition is a market structure that combines elements of both perfect competition and monopoly. In a monopolistically competitive market, there are many firms that produce differentiated products, meaning that consumers perceive the products of different firms as being unique.

This gives each firm some market power, but because there are many firms, no single firm has complete control over the market.

Similarities and Differences between Monopolistic Competition and Perfect Competition

Monopolistic competition and perfect competition are similar in that both market structures have many firms and free entry and exit. However, there are also some key differences between the two market structures.

- In a monopolistically competitive market, firms produce differentiated products, while in a perfectly competitive market, firms produce identical products.

- In a monopolistically competitive market, firms have some market power, while in a perfectly competitive market, firms have no market power.

- In a monopolistically competitive market, there is some barriers to entry, while in a perfectly competitive market, there are no barriers to entry.

Profit-Maximizing Behavior of a Monopolistically Competitive Firm

A monopolistically competitive firm will maximize profits by setting its price and output where marginal revenue equals marginal cost. This is the same profit-maximizing rule that a perfectly competitive firm uses. However, because a monopolistically competitive firm has some market power, it will be able to charge a price that is above marginal cost.

This will result in the firm earning positive economic profits in the short run.In the long run, however, new firms will enter the market and drive down prices. This will eventually lead to the firm earning zero economic profits.

Oligopoly

Oligopoly is a market structure characterized by a small number of large firms that dominate the market. These firms have significant market power and can influence the market price and output.

Characteristics of an Oligopoly Market

-

-*Few firms

A few large firms control a majority of the market share.

-*High barriers to entry

New firms find it difficult to enter the market due to high start-up costs, economies of scale, or patents.

-*Interdependence

Firms are interdependent, meaning their decisions affect each other’s profits.

-*Price rigidity

Prices tend to be sticky and do not fluctuate as much as in other market structures.

-*Non-price competition

Firms compete through non-price factors such as product differentiation, advertising, and innovation.

Types of Oligopoly Models

-

-*Cournot model

Firms compete in quantity, assuming other firms’ outputs remain constant.

-*Bertrand model

Firms compete in price, assuming other firms’ prices remain constant.

-*Stackelberg model

One firm is the leader and sets its output first, while other firms follow.

Strategic Behavior of Firms in an Oligopoly Market

Firms in an oligopoly market engage in strategic behavior to maximize their profits. This can include:

-

-*Collusion

Firms cooperate to set prices and outputs to increase profits.

-*Price leadership

One firm sets the price, and other firms follow.

-*Game theory

Firms use game theory to predict and respond to the actions of their competitors.

-*Product differentiation

Firms differentiate their products to reduce competition and increase market share.

Externalities

Externalities occur when the production or consumption of a good or service affects the well-being of a third party who is not directly involved in the transaction. Externalities can be either positive or negative.

Types of Externalities

- Positive externalitiesoccur when the production or consumption of a good or service benefits a third party. For example, when a company invests in research and development, it can lead to new products and technologies that benefit society as a whole.

- Negative externalitiesoccur when the production or consumption of a good or service harms a third party. For example, when a factory emits pollution, it can damage the health of people living nearby.

Potential Solutions to Externalities

There are a number of potential solutions to externalities, including:

- Government intervention: The government can use taxes, subsidies, or regulations to discourage or encourage certain activities that create externalities.

- Private agreements: Individuals or businesses can negotiate private agreements to address externalities. For example, a factory might pay nearby residents to compensate them for the pollution it creates.

- Property rights: Clearly defined property rights can help to reduce externalities by giving individuals or businesses the incentive to take into account the effects of their actions on others.

Public Goods: Unit 3 Ap Microeconomics Test

Public goods are special goods that possess two unique characteristics: non-rivalrous consumption and non-excludability.

Non-rivalrous consumption means that one person’s consumption of the good does not diminish its availability for others. For example, watching a fireworks display or listening to a radio broadcast are non-rivalrous activities.

Non-excludability means that it is difficult or impossible to prevent people from consuming the good, even if they do not pay for it. For example, it is difficult to exclude people from breathing clean air or enjoying a public park.

Challenges in Providing Public Goods

There are several challenges in providing public goods:

- Free-riding:Because public goods are non-excludable, people have an incentive to free-ride on the contributions of others. This can lead to underprovision of public goods.

- Externalities:Public goods often generate positive externalities, which means they benefit society as a whole. However, these externalities are not always taken into account by private producers, leading to underprovision of public goods.

Role of Government in Providing Public Goods

Because of the challenges in providing public goods, the government often plays a role in their provision. The government can use taxes to finance public goods and can also regulate the production and consumption of public goods.

Income Inequality

Income inequality refers to the uneven distribution of income among individuals or households in a society. It is a measure of the extent to which income is concentrated in the hands of a few individuals or groups, while others have less.

Income inequality is typically measured using the Gini coefficient, which ranges from 0 to 1. A Gini coefficient of 0 represents perfect equality, where everyone has the same income, while a Gini coefficient of 1 represents perfect inequality, where one person has all the income and everyone else has none.

Factors Contributing to Income Inequality

There are many factors that can contribute to income inequality, including:

- Differences in education and skills

- Discrimination in the labor market

- Technological change

- Globalization

- Government policies

Effects of Income Inequality

Income inequality can have a number of negative effects on society, including:

- Reduced economic growth

- Increased poverty and social unrest

- Reduced social mobility

- Increased health problems

- Reduced trust in government

Essential FAQs

What types of market structures are covered in Unit 3?

Unit 3 covers perfect competition, monopoly, monopolistic competition, and oligopoly.

How is consumer demand influenced?

Consumer demand is influenced by factors such as income, tastes and preferences, prices of related goods, and expectations.

What is the significance of production costs?

Production costs play a crucial role in determining the profitability and efficiency of firms, and they can impact market prices and consumer choices.